| Insights |

Property

Investment

| Cotality |

Market {br] Sentiment

Decoding 2026

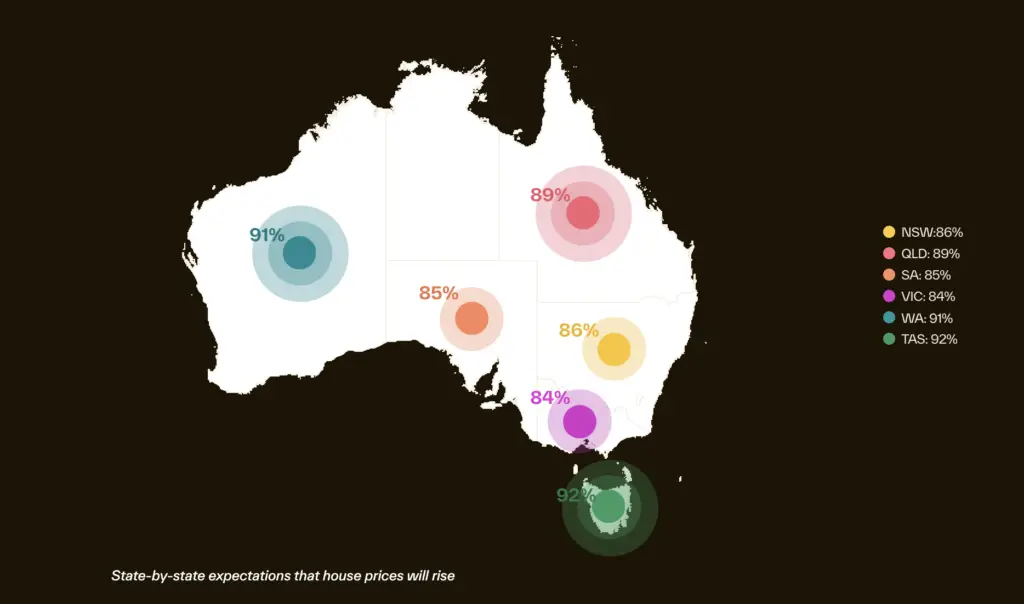

Confidence across Australia’s housing market remains strong entering 2026, but the mood is splitting along state lines as affordability and interest rate jitters reshape the landscape, new Cotality research shows.

Findings from Cotality’s Decoding 2026 report, based on responses from real estate agents and financial professionals across the property and finance sectors, show 87% of respondents expect dwelling values to rise over the year ahead, while only 3.5% anticipate prices will fall.

On the

up and up

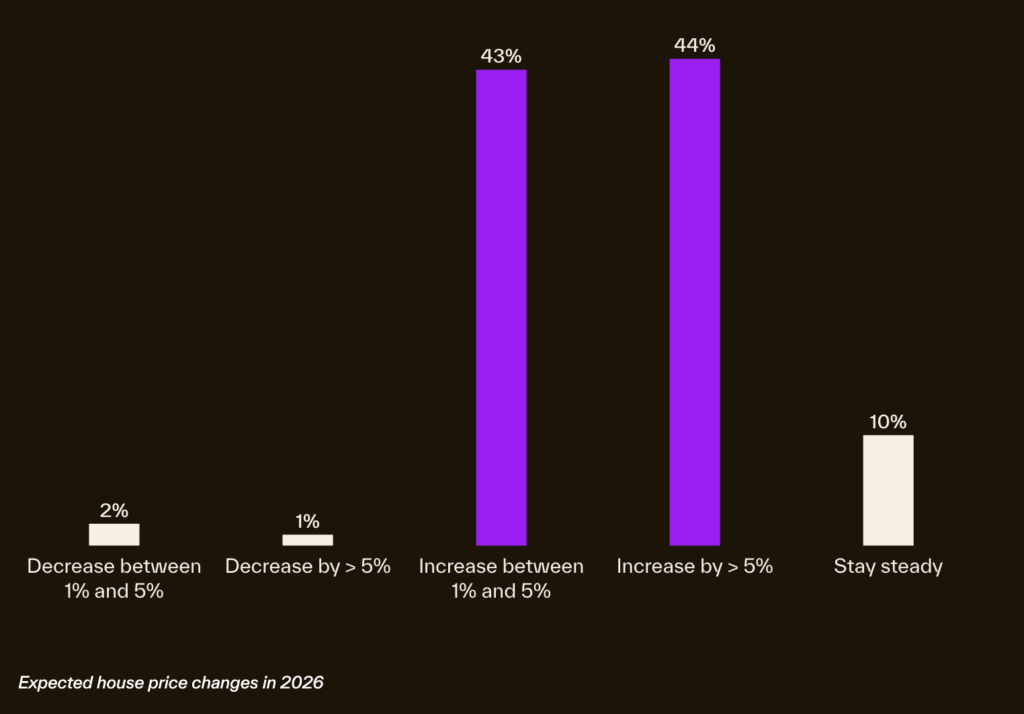

Almost half expect growth above 5%, highlighting the continued market optimism after widespread price gains through 2025.

Cotality’s December Home Value Index showed housing values rose across every capital city and regional market last year, with national dwelling values increasing 8.6% and adding around $71,400 to the median home value.

Insights

Insights drawn from more than 1,100 professionals across Australia and New Zealand, spanning real estate, banking, lending and adjacent property sectors.

In 2026, housing markets across Australia and New Zealand are facing uneven growth, alongside differences in affordability pressures and sharper reactions to policy and credit decisions. Decoding 2026 explores how property professionals are interpreting this environment and what that means for the property sector in the year ahead.

The report draws on responses from professionals working across residential and commercial real estate, banking and lending, and adjacent sectors including mortgage broking, valuation, development and government to provide a frontline view of how the property sector dynamic is shifting.

The findings show market confidence is broadly positive, but increasingly split by state, price point and policy exposure, making headline national figures a general guide to conditions on the ground. Alongside market sentiment, Decoding 2026 also examines how real estate agencies are adapting their digital strategies, including a growing focus on digital independence and first-party data capabilities.

The report frames national and state-level findings in a way that helps industry participants benchmark their experience against the broader market while identifying areas of improvement or emerging risk.

The Growing Digital Divide

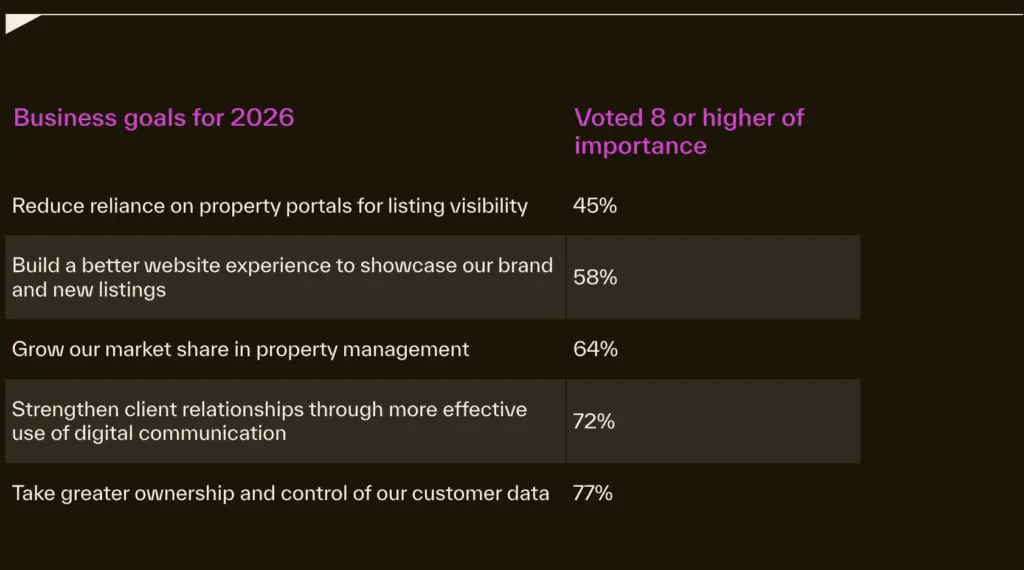

The Decoding 2026 survey highlights differences between stated digital priorities and how agencies currently operate, with responses showing strong interest in customer engagement alongside continued use of established third-party platforms.

As the digital landscape evolves, the ways in which buyers first encounter properties are also changing.

Globally, new channels are emerging, including Google testing property listings directly within search in late 2025, creating new routes for inspection enquiries and agent contact.

These changes have increased attention among agencies around engagement of buyers and sellers and managing relationships across online channels throughout the transaction process.

Survey results show this focus is widely shared, with more than three-quarters of respondents rating improved oversight of customer interactions as highly important.

Data ownership also ranks as a key priority, with 77% of respondents rating greater control of customer data as highly important. Yet this intent is not always reflected in execution.

Summary

Confidence is high but uneven

Industry sentiment entering 2026 remains strongly positive, with very little downside risk priced into expectations.

Nationally, 87% of survey respondents expect dwelling values to rise over the year ahead, while only 3.5% anticipate prices will fall. Almost half, 44%, expect price growth of more than 5%.